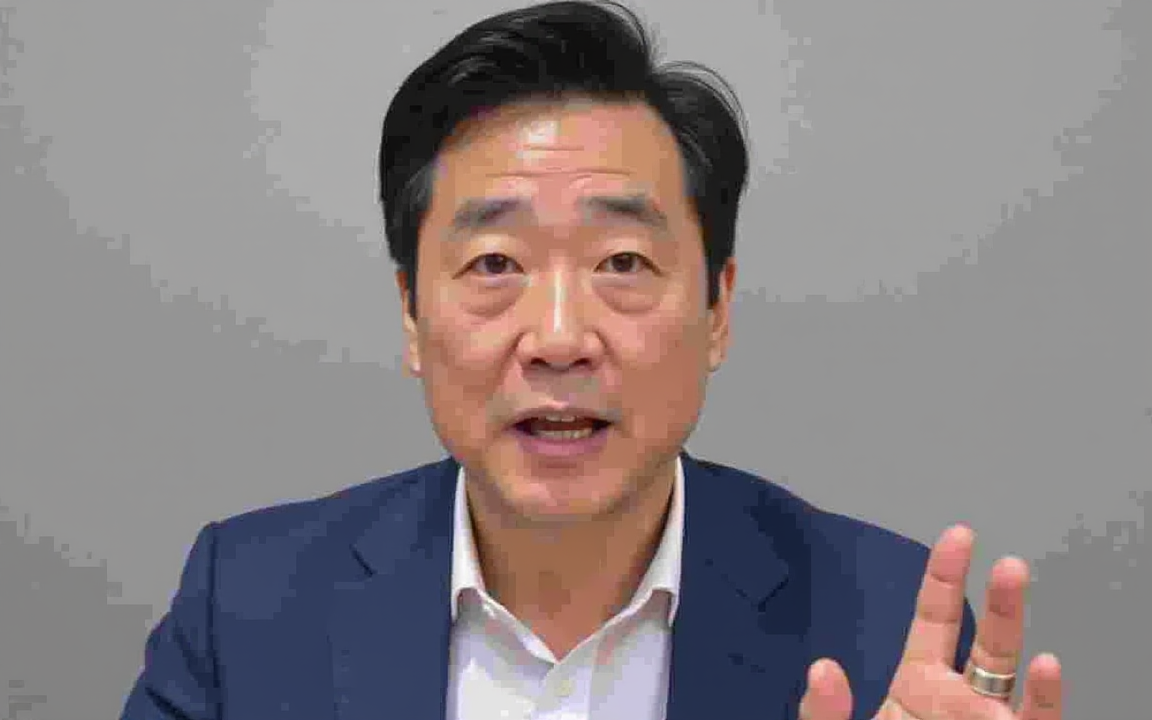

South Korea’s snap presidential election appears to have delivered a victory to opposition leader Lee Jae-myung, a move that could reshape Seoul’s diplomatic and economic strategies.

A joint exit poll by KBS, MBC, and SBS on May 27 projected Lee as the frontrunner, putting him in line to succeed ousted president Yoon Suk Yeol.

This vote was triggered by Yoon’s impeachment, following his declaration of martial law in December 2024 and subsequent removal by the Constitutional Court in April 2025.

Lee, the Democratic Party’s candidate, previously lost by a narrow margin to Yoon in the 2022 presidential race but entered this election with strong polling momentum.

The outcome of this vote will influence South Korea’s upcoming trade decisions with the US, its posture towards China, and diplomatic handling of North Korea.

Trade talks with US may face delays under Lee’s leadership

If confirmed, Lee’s presidency is expected to slow down the pace of trade negotiations with Washington. South Korea and the US had committed to finalising a “package” of agreements on tariffs by July 8.

However, Lee signalled on May 25 that this timeline should be extended, suggesting a more cautious approach.

Eurasia Group’s May 27 briefing estimated Lee had an 80% probability of securing victory, citing his centrist campaign message as a factor in swaying undecided voters.

While Lee moderated his political stance during the campaign, Eurasia believes he will likely implement a more left-leaning policy agenda in office.

The firm highlighted the upcoming supplementary budget as a key indicator of Lee’s economic direction. It also expects his administration to benchmark trade terms against agreements signed by countries like Japan before concluding any US deal.

Economic agenda favours strategic spending and governance reform

Lee’s economic strategy prioritises fiscal support for strategic sectors, diverging from his rival Kim’s platform of deregulation and tax cuts.

According to a May 27 report from Goldman Sachs, Lee seeks to strengthen equity markets via corporate governance reform, while Kim proposed incentives such as lower capital gains taxes.

Goldman anticipates that a Lee administration will pursue a more expansionary fiscal policy compared to Kim.

However, the Bank of Korea (BOK), which cut interest rates last week to their lowest level since August 2022, is expected to partially offset fiscal expansion through tighter monetary controls if necessary.

The rate cut was made in anticipation of slowing growth, with the BOK forecasting a sharp deceleration in South Korea’s economic momentum.

This policy environment will likely shape Lee’s early decisions in office, particularly on spending and stimulus measures.

Won expected to rise as political uncertainty recedes

Despite uncertainties over Lee’s trade policy, financial markets may benefit from greater political stability. Goldman Sachs noted that the South Korean won is likely to appreciate against the US dollar in the short term.

This outlook stems from diminishing policy ambiguity and a broader trend of dollar weakness against Asian currencies.

Lee’s pending legal case over alleged election law breaches had cast doubts on his candidacy earlier in the year. However, the High Court postponed its final ruling until after the election, allowing him to remain in the race.

His victory, if formalised, would remove another layer of uncertainty that has lingered since Yoon’s impeachment proceedings began.

Both Lee and Kim shared similar macroeconomic goals such as housing affordability, financial market stability, and economic growth.

But the differences in how they propose to achieve them could significantly influence South Korea’s policy direction over the next five years.

The post Lee Jae-myung poised to win South Korea’s snap election, risking US trade delays appeared first on Invezz